The Facts About Stonewell Bookkeeping Revealed

Wiki Article

What Does Stonewell Bookkeeping Do?

Table of ContentsOur Stonewell Bookkeeping IdeasGetting The Stonewell Bookkeeping To WorkOur Stonewell Bookkeeping DiariesSome Ideas on Stonewell Bookkeeping You Should KnowThe Ultimate Guide To Stonewell Bookkeeping

Rather of going via a filing cabinet of different files, invoices, and receipts, you can provide in-depth documents to your accountant. After using your bookkeeping to file your taxes, the IRS may choose to carry out an audit.

That financing can come in the type of owner's equity, grants, business loans, and investors. Capitalists require to have a great idea of your business prior to investing.

The Single Strategy To Use For Stonewell Bookkeeping

This is not planned as legal advice; for more details, please click on this link..

We answered, "well, in order to recognize exactly how much you need to be paying, we require to know just how much you're making. What are your profits like? What is your net revenue? Are you in any type of debt?" There was a lengthy pause. "Well, I have $179,000 in my account, so I think my earnings (incomes much less costs) is $18K".

Getting My Stonewell Bookkeeping To Work

While maybe that they have $18K in the account (and also that could not hold true), your balance in the bank does not necessarily identify your revenue. If somebody obtained a give or a loan, those funds are ruled out income. And they would not infiltrate your earnings declaration in establishing your earnings.

While maybe that they have $18K in the account (and also that could not hold true), your balance in the bank does not necessarily identify your revenue. If somebody obtained a give or a loan, those funds are ruled out income. And they would not infiltrate your earnings declaration in establishing your earnings.Numerous things that you believe are costs and deductions are in fact neither. Bookkeeping is the process of recording, classifying, and arranging a firm's economic purchases and tax obligation filings.

A successful service calls for aid from experts. With reasonable goals and a qualified accountant, you can conveniently address challenges and keep those concerns at bay. We dedicate our energy to ensuring you have a solid monetary foundation for growth.

Indicators on Stonewell Bookkeeping You Should Know

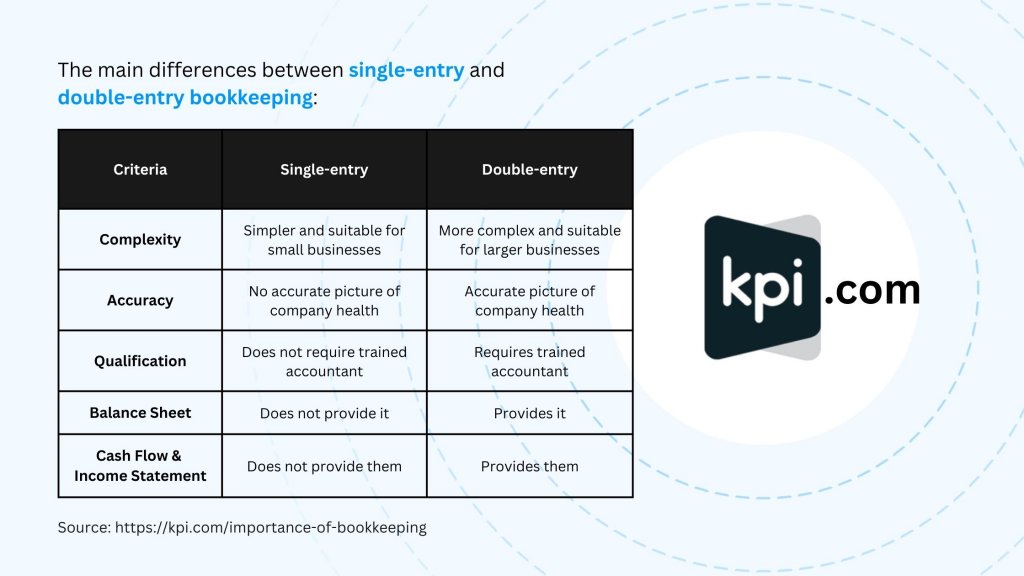

Precise bookkeeping is the backbone of excellent economic administration in any type of company. It helps track revenue and costs, making sure every deal is recorded properly. With excellent accounting, companies can make better choices since clear financial documents provide valuable information that can direct strategy and enhance revenues. This information is vital for long-lasting planning and projecting.Solid accounting makes it simpler to safeguard financing. Precise economic statements construct trust with lending institutions and investors, enhancing your opportunities of getting the funding you require to grow. To preserve solid economic health, services should on a regular basis integrate their accounts. This implies coordinating purchases with financial institution statements my latest blog post to catch mistakes and prevent financial disparities.

They guarantee on-time payment of bills and quick consumer settlement of invoices. This enhances capital and assists to prevent late fines. A bookkeeper will cross bank statements with internal records at the very least once a month to find mistakes or inconsistencies. Called bank settlement, this procedure assures that the economic documents of the firm suit those of the financial institution.

They keep track of current pay-roll information, deduct taxes, and number pay ranges. Bookkeepers generate standard monetary reports, consisting of: Revenue and Loss Statements Reveals profits, costs, and net earnings. Balance Sheets Lists properties, responsibilities, and equity. Money Circulation Declarations Tracks cash activity in and out of the service (https://filesharingtalk.com/members/627904-hirestonewell). These reports assist entrepreneur understand their financial position and make informed decisions.

Examine This Report about Stonewell Bookkeeping

The best choice relies on your budget plan and service needs. Some local business proprietors choose to handle accounting themselves utilizing software. While this is cost-effective, it can be taxing and susceptible to mistakes. Devices like copyright, Xero, and FreshBooks enable company owner to automate bookkeeping jobs. These programs assist with invoicing, financial institution settlement, and financial coverage.

Report this wiki page